Little Known Questions About Offshore Banking.

Table of ContentsHow Offshore Banking can Save You Time, Stress, and Money.Offshore Banking - QuestionsNot known Facts About Offshore BankingThe smart Trick of Offshore Banking That Nobody is DiscussingOffshore Banking Things To Know Before You Buy

Some common types of finances that banks offer include: If your current banks doesn't provide the solutions discussed over, you may not be getting the best banking service feasible. Initially Financial institution, we are devoted to helping our consumers get the most out of their money. That is why we use various sorts of financial solutions to satisfy a range of needs.

Pay costs, lease or top up, purchase transport tickets as well as more in 24,000 UK areas

If you get on the hunt for a brand-new checking account or you desire to start investing, you could need to establish aside time in your timetable to do some study. That's because there are many sort of financial institutions as well as banks. By comprehending the various sorts of banks and also their features, you'll have a better feeling of why they're crucial and just how they play a role in the economy.

Offshore Banking for Dummies

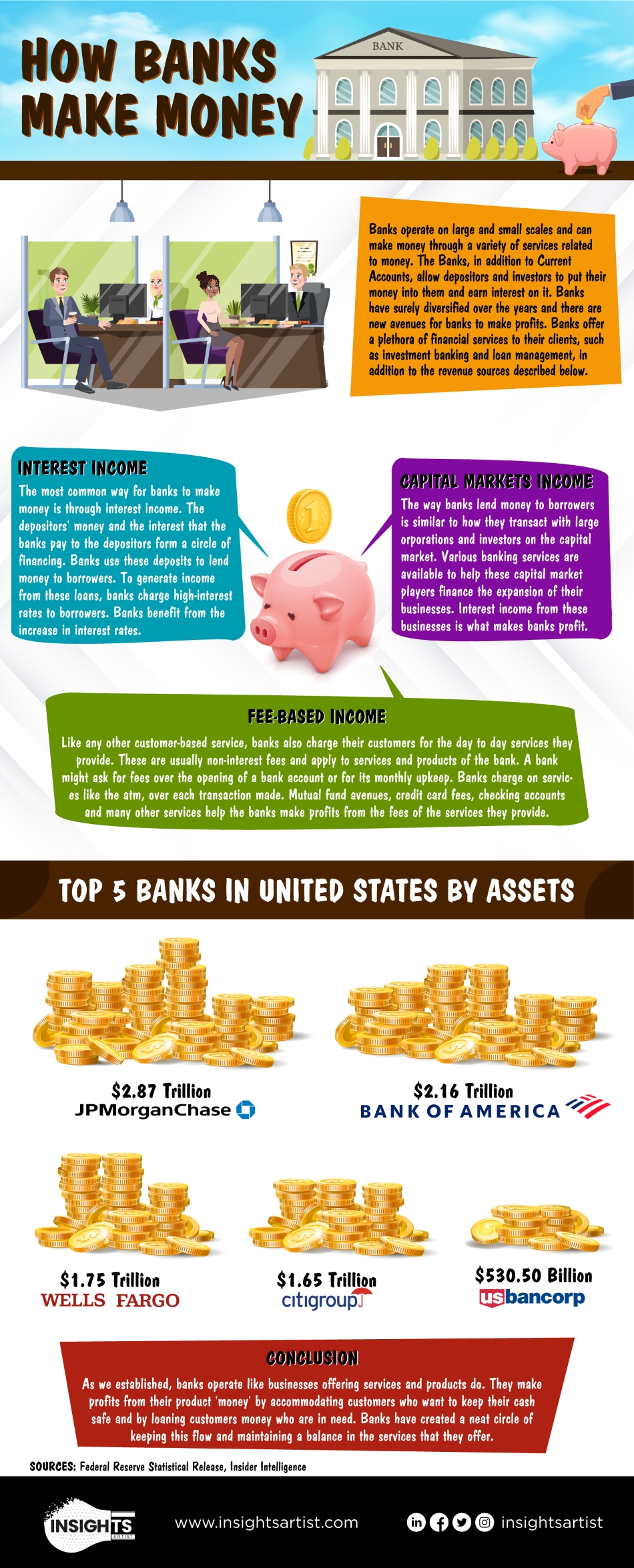

In regards to banks, the reserve bank is the head top dog. Reserve banks take care of the money supply in a single country or a series of countries. They monitor industrial banks, established rate of interest as well as manage the circulation of money. Reserve banks additionally apply a government's monetary policy goals, whether that includes combating depreciation or maintaining rates from fluctuating.

Retail banks can be traditional, brick-and-mortar brand names that clients can access in-person, on-line or through their smart phones. Others just make their devices and accounts offered online or via mobile apps. There are some types of commercial banks that assist day-to-day customers, commercial banks often tend to focus on sustaining businesses.

The shadow banking system contains financial groups that aren't bound by the same rigorous regulations and policies that banks have to adhere to. Just like the basic managed financial institutions, darkness financial institutions manage credit history and various sort of assets. They obtain their funding by borrowing it, linking with financiers or making their own funds rather of making use of cash provided by the main financial institution.

Cooperatives can be either retail financial institutions or commercial banks. What identifies them from various other entities in the economic system is the truth that they're generally regional or community-based organizations whose members assist identify how business is run. They're run democratically and also they offer loans and checking accounts, amongst various other points.

Examine This Report on Offshore Banking

they generally take the type of look at more info lending institution. Like financial institutions, credit report unions issue car loans, supply financial savings as well as examining accounts and fulfill other monetary demands for consumers and also businesses. The difference is that financial institutions are for-profit firms while credit rating unions are not. Cooperative credit union fall under the direction of their own members, who make choices based on the point of views of elected board members.

Participants benefited from the S&L's solutions and earned more rate of interest from their savings than they can at commercial banks (offshore banking). Not all financial institutions offer the exact same purpose.

Gradually, they have been extensively used by both innovative book supervisors and also by those with even more uncomplicated requirements. Sight/notice accounts as well as dealt with and also drifting price down payments Fixed-term down payments, additionally denominated in a basket of money such as the SDR Adaptable amounts and also maturities An eye-catching financial investment widely utilized by get managers looking for extra return as well as exceptional credit score top quality.

This paper provides a method that banks can use to help "unbanked" householdsthose who do not have accounts at deposit institutionsto join the mainstream monetary system. The primary purpose of the approach is to help these homes build financial savings and improve their credit-risk profiles in order to decrease their cost of repayment solutions, eliminate a typical source of individual stress and anxiety, and also gain accessibility to lower-cost resources of credit report.

10 Simple Techniques For Offshore Banking

Third, it is much better structured to aid the unbanked become standard financial institution customers. Fourth, it is also likely to be a lot more profitable for financial institutions, making them a lot more prepared to implement it.

They have no immediate need for credit rating or do find here not locate that their unbanked standing excludes them from the credit report that they do require. Settlement solutions are additionally not bothersome for a range of reasons.

Many financial institutions in urban areas won't cash paychecks for people that do not have an account at the financial institution or that do not have an account with adequate funds in the account have a peek here to cover the check. It can be quite pricey for somebody living from income to income to open a checking account, even one with a low minimum-balance need.

Each jumped check can set you back the account holder $40 or more since both the check-writer's bank as well as the vendor who accepted the check frequently enforce charge fees. It is additionally expensive as well as bothersome for financial institution customers without checking accounts to make long-distance settlements. Nearly all financial institutions bill a minimum of $1 for cash orders, and numerous cost as high as $3.

The Greatest Guide To Offshore Banking

As noted in the intro, this paper says that one of the most effective as well as cost-efficient ways to bring the unbanked into the banking system need to involve 5 actions. Below is a description of each of those steps as well as their rationales. The primary step in the recommended strategy gets in touch with participating banks to open up specialized branches that provide the full variety of industrial check-cashing services in addition to conventional consumer banking solutions.